Image via Wikipedia

Image via WikipediaYou have heard stories of traders or punters made good by investing all their money into 1 stock and newspaper stories proclaiming how a trader can turn $1,000 into $100,000 in 1 month or even having 1000% return on investment.

For a beginner to investment, they might be convinced that the only way to get rich is to have concentrated bets. However, that is also the quickest way to the poor house if the bet goes wrong.

For myself, there are 3 rules of investing I stick to.

Rule 1 - Diversification thru' an Asset Allocation Approach

Some of you may disagreed and quote numerous gurus that made it good thru concentrated bets. It's a case of "Put all your eggs in One Basket and Watching it very carefully" versus "Don't put all your eggs in One Basket".

However, you need to know that they are not called gurus for nothing. Some people have the innate ability to see trends and hidden gems. Some people used discipline and smart intellectual ability to find the gems. If you are one of them, I am happy for you! :)

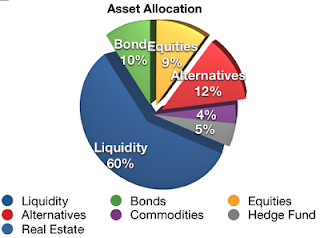

For the rest of us, we can take comfort in using the proven asset allocation principles in our investment portfolio. Yes, investing is not only about shares. Asset allocation is derived from the Nobel Winning "Modern Portfolio Theory" where rational investors diversified their investments into different non-correlated asset classes to achieve an optimal risk return reward ratio. You can read more about MPT in wikipedia.

Thru' a well designed portfolio, investment professionals (including Yale endowment CIO, David Swensen) have found that around 90% of your returns are achieved thru' good asset allocations. The rest of the 10% can be attributed to market timing and stock picking. So, if you are someone who believes in the 80/20 Pareto's Law, you should focus 80% of your energy on doing the simple asset allocation that matters the most!

I'll give you Rule 2 and 3 in the next blog. Time for dinner now.