I think of asset allocation as a deliberate act of investment strategy (Tactical Allocation). You could increase your allocation to cash(acting as opportunity fund) if you see stormy road ahead and want to have cash handy. Or you could overweight a particular asset class (example equities) when you think it will underperform/outperform the rest. A lot of the value investors (Martin Whitman, Seth Klarman, Monish Prabrai etc) I studied mentioned they have been overweight cash (ie increasing their cash allocation in their portfolio) last year but now have been gradually using it. So it's deliberate and they understand that they need the cash to scoop up the opportunities. They admit they cannot time the bottom but they also know when to pull out as they can't find any workout opportunites nor undervalued equities (as most equities were overvalued).

On the part of selling, most mentioned they have sell rules and it is dependent on how overvalued the equities is in relation to their portfolio (ie rebalancing) and whether better investment opportunities exist that they can sell out overvalued equities and moved into the better valued investment opportunities. In other words, they do locked in profits and Martin Whitman admits that his sell rule caused him to sell early but it is part and parcel of being a value investor.

The Pursuit of Wealth Thru' Capital Preservation and Appreciation.

About Wealth Journey

An Accreditated Investor's views on wealth management. My views may differ from yours but all roads lead to Rome.

Views expressed are my own and do not constitute advice to the public. Please speak to a qualified financial professional about your investment.

Views expressed are my own and do not constitute advice to the public. Please speak to a qualified financial professional about your investment.

Friday, January 23, 2009

Saturday, January 17, 2009

Buffett Quotes

Buffett quotes are really timeless.

He says something along the line of

1) "When the tide recedes, you will find who is the naked swimmers"...

2) "A rising tide raises all boats"

In good times(rising tide), fraudsters or ponzi scheme and lousy strategic decisions by lousy CEOs can all be masked. There is virtually no difference between good and bad decisions or CEOs. But when the tide recedes, you will find who are the one who are good and who are the fraudsters.

He says something along the line of

1) "When the tide recedes, you will find who is the naked swimmers"...

2) "A rising tide raises all boats"

In good times(rising tide), fraudsters or ponzi scheme and lousy strategic decisions by lousy CEOs can all be masked. There is virtually no difference between good and bad decisions or CEOs. But when the tide recedes, you will find who are the one who are good and who are the fraudsters.

Monday, January 12, 2009

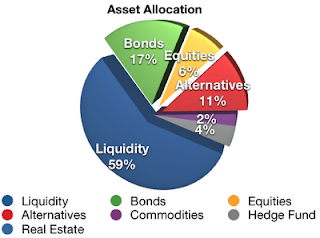

Portfolio Update January 2009

Return YTD : -12.41%

Return YTD : -12.41%I have put some money to work in equities and corporate convertible bonds. Will be putting some more over the next 2 months (maybe 8%) buying up bonds and equities.

Tuesday, January 6, 2009

Even investing experts don’t always walk the walk (The Wall Street Journal Asia, 06 Jan 2009, Page 32)

By Jason Zweig

The Wall Street Journal Asia

06 Jan 2009

If you think it is hard to stick to your New Year’s resolutions, consider how some of the investing world’s leading experts don’t always take their own advice. Often, they diversify by the seat of their pants, fail to adjust their portfolios to...read more...

Subscribe to:

Posts (Atom)