Portfolio Return YTD : -2.51%

The Pursuit of Wealth Thru' Capital Preservation and Appreciation.

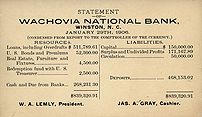

Image via Wikipedia Hope everyone have taken a lesson from this market downturn.

Image via Wikipedia Hope everyone have taken a lesson from this market downturn. Image by Getty Images via Daylife I have been emphasizing the need to diversify your investments and not to concentrate most of it on just one single investment.

Image by Getty Images via Daylife I have been emphasizing the need to diversify your investments and not to concentrate most of it on just one single investment. Image via Wikipedia If you looked at most of the recent financial crisis (LTCM, Asian Financial Crisis, Subprime), they were all started because of shaken confidence in the financial system. What followed were the credit problems appearing as companies or individuals who over-leveraged began having problem servicing their loan repayment obligation. Firms/individuals who have strong cashflow/income ability were able to survive but there were also numerous cases of bankruptcies or firesales for entities with weak cashflow.

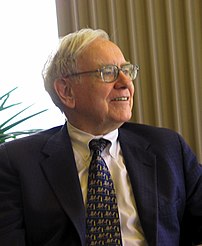

Image via Wikipedia If you looked at most of the recent financial crisis (LTCM, Asian Financial Crisis, Subprime), they were all started because of shaken confidence in the financial system. What followed were the credit problems appearing as companies or individuals who over-leveraged began having problem servicing their loan repayment obligation. Firms/individuals who have strong cashflow/income ability were able to survive but there were also numerous cases of bankruptcies or firesales for entities with weak cashflow. Image via Wikipedia If you want to know more about value investing but are often put off by most books out there that tries to explain investing in such a boring manner, Warren Buffett's letters to Berkshire's shareholders are easy read.

Image via Wikipedia If you want to know more about value investing but are often put off by most books out there that tries to explain investing in such a boring manner, Warren Buffett's letters to Berkshire's shareholders are easy read. Image by Getty Images via Daylife

Image by Getty Images via Daylife Warren Buffett's Investing Questions

Before Warren Buffett invests a dime, he asks:

In short, he makes companies jump through a lot of hoops before he considers putting them in his portfolio.

Source : InvestmentU

Image via Wikipedia When you buy into an equity investment (stocks or funds), you are mainly buying into the potential for capital appreciation and not so much for its dividend. However, when choosing an investment, a safer bet would be to go with the one with a consistent and sustainable dividend policy. Studies have shown this is a good barometer of future capital appreciation of an investment.

Image via Wikipedia When you buy into an equity investment (stocks or funds), you are mainly buying into the potential for capital appreciation and not so much for its dividend. However, when choosing an investment, a safer bet would be to go with the one with a consistent and sustainable dividend policy. Studies have shown this is a good barometer of future capital appreciation of an investment. Have you ever read analyst report recommending a certain stock and putting it at "Outperform/overweight" and have a Target Price(TP) or Sum of the parts (SOTP) at $4.20?

Have you ever read analyst report recommending a certain stock and putting it at "Outperform/overweight" and have a Target Price(TP) or Sum of the parts (SOTP) at $4.20?So instead of listening to analysts, do your own research and ask the right questions, like these:

Image by alemdag via Flickr A nice quote I got from "The Joseph Cycle" by Simon Sim.

Image by alemdag via Flickr A nice quote I got from "The Joseph Cycle" by Simon Sim.The more you save, the more you will have. Saving creates wealth; wealth attracts more wealth. Thus, it is said, "Money makes money!".Anyway, the Joseph Cycle is a good read for people who are interested in economic cycles and how it can help in stock investment. For those in a hurry, the gist of the book is in credentialing and validating the Biblical Joseph Cycle of 7 Fat years and 7 lean years. The Joseph Cycle equates to a 7 year bull and 7 year bear in the stock market. After which, Simon mentions that for most, we have only 2 opportunities within our lifetime to take advantage of these cycles. The beginning of the last bull started in 2001 and will end somewhere inside 2008. After which, there will be the 7 years bear from 2009-2015. Thus, the year 2015 will be the bottom as well as the next start of a bull and if we believe in the Joseph Cycle, we will do well to invest during the start of the bull and hold on till the end of the cycle, ignoring most crisis along the way. But he does mentioned that you can still invest even if it's a bear cycle as long as the stock is undervalued or a crisis present an opportunity.