Good for a read for anyone who's interested. Compared to him, I am ball-less 'coz he also short CDL in this article. This is conviction man..

http://www.masteryourfinance.com/forum/phpBB2/viewtopic.php?p=17586#17586

Short term trading vs Investing, what's the difference?

Based on the Rich people I know, including myself, NONE of us become Rich or make millions from short term trading. We make millions by Investing, by Buy Low, Sell High based on Major Market Trends.

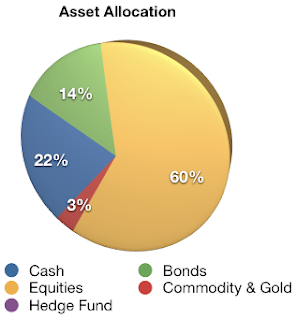

There are times we do NOTHING, and money sits there idly, (actually we purposely raise our Cash level to have Opportunity Fund). Becos to a Real Investor, there is a Time to Invest, and there is a time to Raise Cash and do nothing. eg. right now I have 70% of my wealth sitting in Cash.

I don't bother about inflation, becos when I deploy my Opportunity Fund, minimum returns I aim is 50%, so what is 5% inflation to me?

Becos when we invest, we don't invest like 1% to 5% of our wealth (that is what a prudent trader should limit max exposure to each trade), we may invest 50% of our wealth or even 100% of our wealth fully invested (but in different investments).

And we deploy our funds to make minimum 50% returns. So imagine, if a person has wealth of S$100,000. Investing 100% of it, and make 50% make S$50,000. While a trader has S$100,00, cap trading to max 1% to 5% of wealth to a trade, or only traded $5,000 and even if make 100%, only make $5,000.

So in this example, the Trader needs to have 10 winning trade to make as much money as the Investor making a 1 time investment. And what if the investor makes 2 rounds of 100%....well, then the trader is left further and further behind, since the Investor now would have S$300,000 (grew from S$100,000) and the Trader might have S$100,000 + S$10,000 or S$110,000 Wealth.

Trading is lots of fun, quite a lot of action, but really, look around at all the Rich people around, and you would realise that NONE of them make REALLY Big money from Trading.

Even Remiser King Peter Lim (a billionaire) cautions people that one can't make much money from trading when he was interviewed.

For me, I think overall market trend is down, so I shorted City Development at S$10 instead, of course price can rebound, but overall trend is down.

Last round, I shorted S$10.70 and bought back at S$9.20, then I waited for price to shoot up to S$10 and shorted it again, still holding on to my short position.

I'm unlikely to Long, buy any stocks for the near future as long as the overall Market Trend is down, not up.

_________________

Cheers!

Dennis Ng - When You Master Your Finances, You Master Your Destiny

Note: I'm just sharing my personal comments, not giving you investment advice nor stock investment tips.