There are some considerations if you are still interested in purchasing an investment property :-

1) Rental for residential cannot go up higher anymore unlike the last few years when it keep on increasing on the prospect of increasing demand

2) Interest rate cannot go down lower anymore unlike the last few years when FED and other Central banks are openly supporting the QE ,indirectly driving interest rate down

3) Prices cannot go up higher anymore if we have basically doubled from the 2009 low and effectively kept up with the money supply resulting from the global QEs.

Here is the three formula you need to know :

i) Property Yield = Rental / Purchase Price

ii) (+/-)Cashflow = Rental - Installment Payment(principal+interest)

iii) ROIC (return on invested capital) =

[ Gross Rental - Interest paid(exclude principal) - Misc Expenses)] / Downpayment

(Often in the high 8% to double digit % if you are using max loan with 20% downpayment.)

So if you can hold for the long term and assuming rental yield never goes down, interest rate never goes up and property prices recover to your purchase price and beyond, you will actually be getting quite a good return annually at 8%++.

4) Singapore's Economic Restructuring and the impact to GDP?

5) Coming Election 2015/16 - Is it in the party's interest to have lower or higher property prices before election? The flood gates can of course be opened after election.

6) Supply > Demand? General observation there is more supply out there(unsold units or taking longer to clear new launches) and general tightening in demand thru' foreign workers/professional quota. I'm sure everyone knows the supply is built for the opening of the floodgate right after the election :) But in the meantime, Supply > Demand.

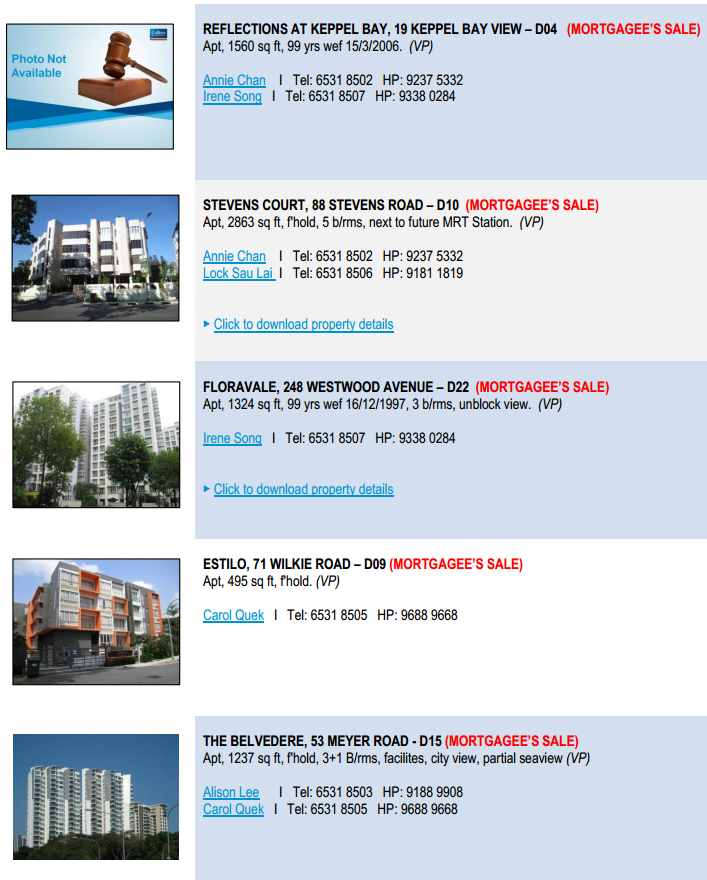

Attached is the list of mortgagee's sales.

No comments:

Post a Comment